AN EMPIRICAL EXAMINATION OF CRUDE OIL, GOVERNMENT EXPENDITURE AND ECONOMIC GROWTH OF NIGERIA FROM 1981 TO 2014

Abstract

Author(s): Abula, Matthew and Ben, Daddy Mordecai

This study empirically examined the relationship between crude oil, government expenditure and economic growth of Nigeria for the period 1981 to 2014 using annual time series data on such variables as oil revenue, oil export, government expenditure and real GDP. The study employed the Vector Autoregression method. The findings of the multivariate VAR model revealed that there exists a significant long-run relationship between oil revenue, oil export, government expenditure and economic growth of Nigeria, judging from the high R2 of the real GDP, oil revenue, oil export and government expenditure regressions of 0.998386, 0.949942, 0.968170 and 0.980322 respectively, and their respective F value (1778.155, 54.55815, 87.44791 and 143.2310). The variance decomposition analysis revealed that oil revenue and oil export exerts more pressure on government spending than it does to economic growth. Meanwhile, government expenditure has a highly significant influence on economic growth. The findings of the impulse response function in support of the variancedecomposition analysis revealed that oil revenue, oil export and government spending have direct effects on economic growth of Nigeria. Also, economic growth, oil revenue and oil export significantlyinfluences government spending in the country. The study therefore recommended that macroeconomic policies aimed at enhancing output in the oil sub-sector should be embarked upon by the government. In doing so, revenue would improve and more funds would be available for spending and hence, increase economic growth.

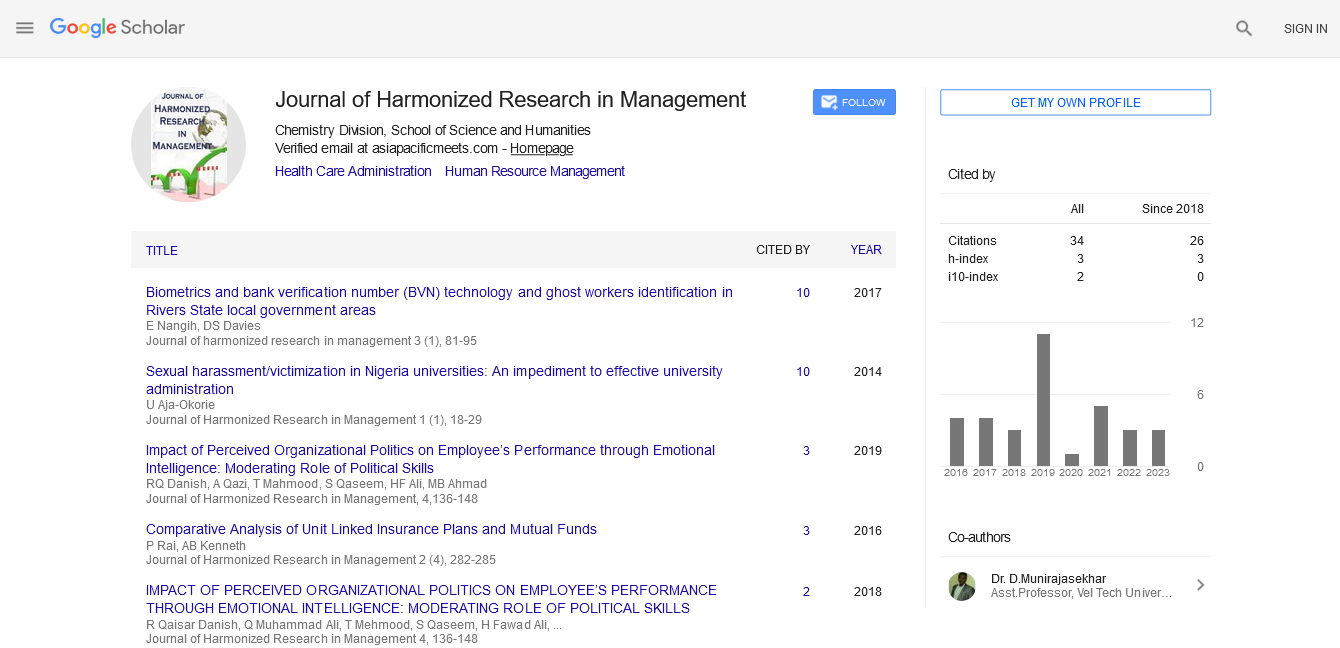

Google Scholar citation report

Citations : 92

Journal of Harmonized Research in Management received 92 citations as per google scholar report