Commentary - (2021) Volume 7, Issue 1

A BRIEF NOTE ON CORPORATE ADMINISTRATION

William*Received: Sep 03, 2021

Description

Corporate administration is the assortment of systems, cycles and relations utilized by different gatherings to control and to work an organization. Administration constructions and standards distinguish the appropriation of rights and obligations among various members in the company like the top managerial staff, administrators, investors, loan bosses, reviewers, controllers, and different partners and remember the guidelines and methodology for settling on choices for corporate undertakings. Corporate administration is vital in view of the chance of irreconcilable circumstances between partners, fundamentally among investors and upper administration or among investors.

Corporate administration incorporates the cycles through which organizations’ targets are set and sought after with regards to the social, administrative and market climate. These incorporate observing the activities, approaches, practices, and choices of companies, their representatives, and influenced partners. Corporate administration practices can be viewed as endeavours to adjust the interests of partners.

Premium in the corporate administration practices of present day organizations, especially according to responsibility, expanded after the high-profile falls of various huge companies in 2001- 2002, a large number of which included bookkeeping extortion; and afterward again after the monetary emergency in 2008.

Corporate outrages of different structures have kept up with public and political premium in the guideline of corporate administration. In the U.S. these have included outrages encompassing Enron and MCI Inc. Their destruction prompted the authorization of the Sarbanes-Oxley Act in 2002, a U.S. government law expected to work on corporate administration in the US. Tantamount disappointments in Australia are related with the possible section of the CLERP 9 changes there (2004), that likewise planned to work on corporate administration. Comparable corporate disappointments in different nations animated expanded administrative premium.

The requirement for corporate administration follows the need to moderate irreconcilable circumstances between partners in companies. These irreconcilable circumstances show up as an outcome of separating needs between the two investors and upper administration (head specialist issues) and among investors (head issues), albeit additionally other partner relations are influenced and composed through corporate administration.

In huge firms where there is a detachment of proprietorship and the executives, the head specialist issue can emerge between upper-administration the specialist and the shareholders the principals. The investors and upper administration might have various interests. The investors regularly want profits from their ventures through benefits and profits, while upper administration may likewise be affected by different thought processes, like administration compensation or abundance interests, working conditions and perquisites, or associations with different gatherings inside (e.g., the executives specialist relations) or outside the enterprise, to the degree that these are excessive for benefits.

Those relating to personal circumstance are generally stressed according to head specialist issues. The viability of corporate administration rehearses according to an investor viewpoint may be decided by how well those practices adjust and organize the interests of the upper administration with those of the investors. Nonetheless, enterprises in some cases attempt drives like environment activism and will full outflow decrease, that appears to repudiate the possibility that reasonable personal responsibility drives investors’ administration objectives.

An illustration of a potential clash among investors and upper administration emerges through stock repurchases depository stock. Leaders might have impetus to redirect cash excesses to purchasing depository stock to help or build the offer cost. In any case, that decreases the monetary assets accessible to keep up with or upgrade productive activities. Therefore, leaders can forfeit long haul benefits for momentary individual increase. Investors might have alternate points of view in such manner, contingent upon their own time inclinations, however it can likewise be seen as a clashing with more extensive corporate interests counting inclinations of different partners and the drawn out reliability of the company.

Conclusion

The head specialist issue can be increased when upper administration follows up for various investors which is frequently the situation in huge firms (see Numerous primary issue). In particular, when upper administration follows up for the benefit of various investors, the different investors face an aggregate activity issue in corporate administration, as individual investors might campaign upper administration or in any case have motivators to act to their greatest advantage instead of in the aggregate revenue, all things considered.

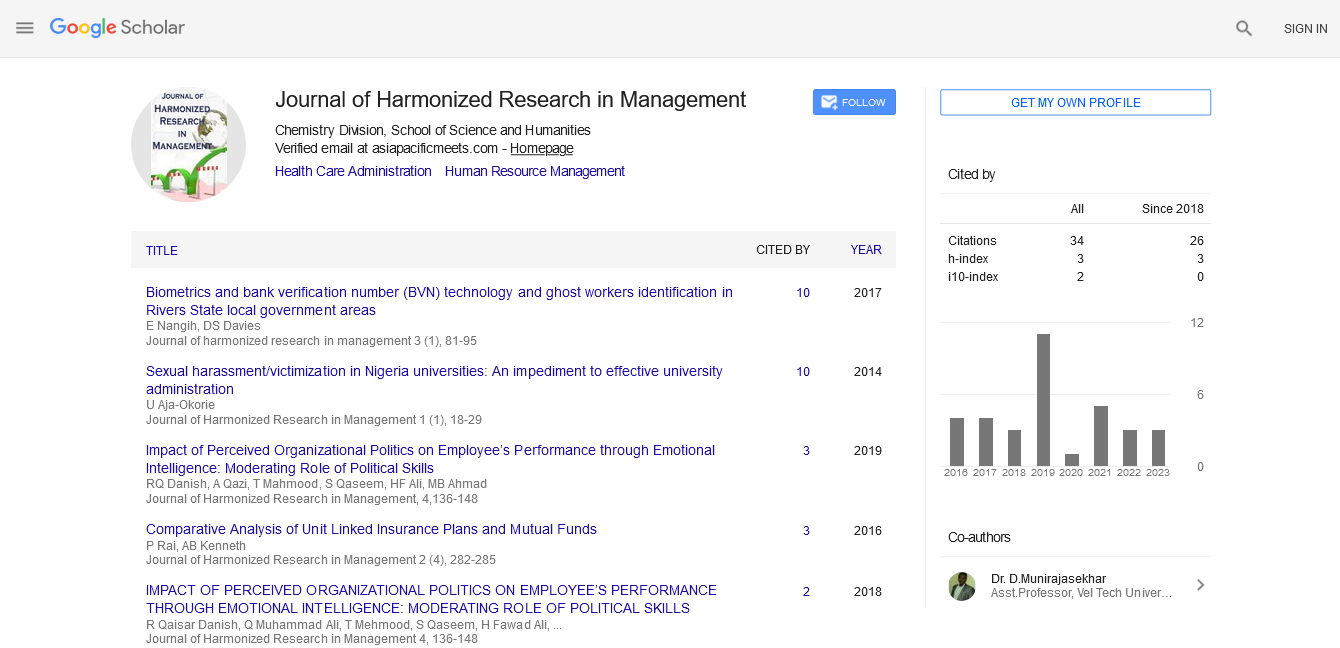

Google Scholar citation report

Citations : 92

Journal of Harmonized Research in Management received 92 citations as per google scholar report